Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Did you know that 63% of millennials live paycheck to paycheck? Navigating today’s financial world can feel overwhelming—I’ve been there. As a millennial who turned my finances around through reading, I can confidently say that the right books can change everything. Whether you’re drowning in student loans, dreaming of homeownership, or simply tired of living paycheck to paycheck, these carefully chosen finance books are game-changers for our generation. Let’s dive into the must-read personal finance books for millennials that actually speak our language!

Unlike previous generations, millennials face an entirely different economic reality. The weight of student loan debt makes saving, investing, or buying a home more challenging than ever. Meanwhile, skyrocketing housing costs and a rising cost of living create additional financial stress.

At the same time, traditional career paths are becoming less common. Many millennials are turning to gig work, freelancing, and non-traditional jobs for financial stability. While these options offer flexibility, they also require a new approach to money management.

On the bright side, the digital age has opened up more investment opportunities than ever before. From cryptocurrency to index funds, young investors have access to wealth-building tools previous generations never imagined. However, with an uncertain retirement future and unpredictable market conditions, making smart financial decisions is more crucial than ever.

Millennials don’t just need generic financial advice—they need resources that address their specific challenges. The combination of student debt, rising living costs, and a shifting job market makes personal finance more complex than ever. Technology and globalization have reshaped the economy, creating both new opportunities and new risks.

That’s why a diverse collection of finance books is essential. Whether you’re looking to master budgeting, navigate student loan repayment, start investing, or build wealth through side hustles, the right books can provide actionable strategies tailored to modern financial realities.

1. Managing Student Loan Debt

With student loan debt reaching record highs, many millennials struggle with repayment while balancing other financial goals. Books on student loan debt management provide strategies for refinancing, budgeting, and paying off loans faster.

2. Building Strong Money Management Skills

Many millennials didn’t receive formal financial education, making personal finance books essential for learning budgeting strategies, credit management, and responsible spending habits.

3. Navigating the Gig Economy & Side Hustles

Traditional 9-to-5 jobs are no longer the only career path. Books on side hustles, freelancing, and passive income help millennials diversify their income and achieve financial security.

4. Investing & Wealth Building

Millennials are looking for ways to build wealth beyond traditional savings accounts. Books on stock market basics, index fund investing, and real estate investment provide beginner-friendly guidance.

5. Planning for Retirement Early

Unlike previous generations with pensions, millennials must actively plan their retirement through 401(k)s, IRAs, and other investment strategies. Books on retirement planning help them start early and maximize their savings.

6. Mastering Digital Finance & FinTech

With the rise of digital banking, cryptocurrency, and online investing platforms, millennials need books that explain modern financial tools and technologies.

7. Achieving Financial Independence & Early Retirement (FIRE)

Many millennials are drawn to the idea of financial independence and retiring early. Books on the FIRE movement offer strategies for aggressive saving, smart investing, and minimalist living.

8. Understanding Money Mindset & Behavioral Finance

Financial success isn’t just about numbers—it’s also about mindset. Books on money psychology help millennials overcome financial anxiety, build confidence, and develop healthy financial habits.

If you don’t find a way to make money while you sleep, you will work until you die.”

Considered one of the most transformative personal finance books, Your Money or Your Life teaches readers how to rethink their relationship with money. Vicki Robin provides a step-by-step plan to achieve financial independence by tracking expenses, cutting unnecessary spending, and aligning money with personal values. This updated edition includes strategies for digital money management and modern investing.

Key Benefits:

• Teaches mindful spending and financial independence

• Practical exercises for budgeting and saving

• Updated for today’s economy and digital finance

Accolades & Recognition

New York Times Bestseller

Over 2 million copies sold worldwide

Featured in The Washington Post, Forbes, and The New York Times

Recommended by financial independence advocates, including Mr. Money Mustache

Named one of the best personal finance books of all time by Business Insider

This book provides a beginner-friendly, step-by-step system for mastering money management. Aliche’s 10-step approach includes budgeting, saving, debt payoff, and building an emergency fund, making it perfect for young adults looking to take control of their finances.

Key Benefits: Simple, practical worksheets, real-life case studies, and strategies for financial security.

Accolades & Recognition

New York Times, Wall Street Journal, and USA Today Bestseller

Over 500,000 copies sold

#1 Amazon Best Seller in budgeting and personal finance categories

Featured in Forbes, CNBC, and The New York Times

Endorsed by financial experts like Dave Ramsey and Suze Orman

Included in Time Magazine’s Best Finance Books for Beginners

Originally written as a guide for his daughter, Collins’ book breaks down investing into a no-nonsense, easy-to-follow strategy. It focuses on index investing, financial independence, and long-term wealth-building with minimal effort.

Key Benefits: Passive investing, wealth accumulation, and an easy-to-understand approach for beginners.

Accolades & Recognition

Over 1 million copies sold

Named one of the Best Personal Finance Books of All Time by Business Insider

Frequently recommended by the Financial Independence, Retire Early (FIRE) community

Featured in Forbes, The New York Times, and MarketWatch

Endorsed by popular finance bloggers like Mr. Money Mustache

This book explores how emotions, biases, and behaviors impact financial decisions. Through engaging stories and psychological insights, Housel teaches readers how to develop a wealth-building mindset.

Key Benefits: Behavioral finance insights, relatable real-world examples, and mindset shifts for financial success.

Accolades & Recognition

New York Times, Wall Street Journal, and USA Today Bestseller

Over 3 million copies sold worldwide

#1 Amazon Best Seller in investing and behavioral finance

Named one of the Best Finance Books of the Year by The Financial Times

Featured in CNBC, Bloomberg, and The Wall Street Journal

Translated into over 50 languages

A must-read for millennials struggling with student loans, this book offers practical strategies for repayment, loan forgiveness programs, and income-driven repayment plans.

Key Benefits: Debt payoff plans, refinancing strategies, and real-life success stories.

Accolades & Recognition

Featured in Forbes, Business Insider, and U.S. News & World Report

Written by the founder of Young Adult Money, a top financial education platform

Frequently recommended by student loan experts and financial advisors

A relatable, no-BS guide to navigating money as a millennial. Lowry covers student debt, credit scores, budgeting, and how to handle money in social situations.

Key Benefits: Funny, millennial-focused, and full of actionable money management tips.

Accolades & Recognition

Amazon Best Seller in personal finance for young adults

Named one of the Best Financial Books for Millennials by Business Insider

Featured in The New York Times, The Washington Post, and CNBC

Part of a best-selling series, including Broke Millennial Talks Money and Broke Millennial Takes on Investing

This book covers investing, retirement planning, and understanding market fundamentals, all tailored to the challenges millennials face today.

Key Benefits: Modern investment strategies, career-focused financial planning, and wealth-building principles.

Accolades & Recognition

Featured in CNBC, Forbes, and Business Insider

Written by Douglas Boneparth, a Certified Financial Planner and millennial money expert

Recommended by Young Money University and financial independence advocates

A mix of personal finance and lifestyle advice, this book teaches millennials how to budget, invest, and make smart career and money decisions.

Key Benefits: Budget-friendly living tips, career and finance advice, and real-life millennial money stories.

Accolades & Recognition

Amazon Best Seller in budgeting and personal finance

Based on the popular Financial Diet blog and YouTube channel with over 1 million subscribers

Featured in Forbes, Business Insider, and Refinery29

Named one of the Best Books for Millennial Women by Bustle

A practical guide to launching a profitable side hustle in less than a month, with actionable steps and success stories.

Key Benefits: Business ideas, startup strategies, and revenue generation tips.

Accolades & Recognition

Wall Street Journal and USA Today Bestseller

Written by Chris Guillebeau, New York Times bestselling author and host of the Side Hustle School podcast

Featured in Forbes, Inc., and Fast Company

Named one of the Best Books for Starting a Business by Entrepreneur Magazine

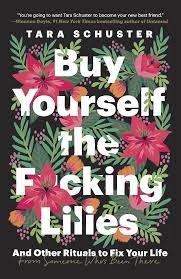

A unique blend of self-care and financial growth, this book emphasizes investing in yourself, career success, and money management.

Key Benefits: Career confidence, self-improvement, and work-life balance tips.

Accolades & Recognition

Amazon Best Seller in personal development and self-helpFeatured in The New York Times, Oprah Daily, and BuzzFeedNamed one of the Best Books for Women in Their 20s & 30s by Refinery29Recommended by celebrities including Chelsea Handler and Adam Grant

Taking control of your financial future doesn’t have to be overwhelming! These carefully selected personal finance books provide the roadmap you need to navigate today’s unique economic challenges. Whether you’re just starting your financial journey or ready to take your money management to the next level, there’s a perfect guide waiting for you. Ready to transform your financial life? Pick up one of these recommended reads today and take the first step toward financial freedom. Remember, investing in your financial education is one of the smartest money moves you can make!