What Exactly Is an Option? (Simple Breakdown)

- Definition: An option is a contract giving you the right—but not the obligation—to buy or sell a stock at a set price before a set date

- Basic terms:

- Call = right to buy a stock

- Put = right to sell a stock

- Strike price, expiration date, premium (what you pay)

- Risk capped: Buyers lose just the premium; sellers can face bigger losses

3. Who’s Who in the Options Game

- There are 4 players: call buyer, call seller, put buyer, put seller.

- Buyers: limited risk (the premium), but tons of upside.

- Sellers: pocket the premium—but risk can be huge

Check out our blog about the best online brokers to start trading with today!

| | | | | |

| | | | 1 free stock after linking bank account. Stock value range($5.00-$200). | |

| | | | Receive up to 40 free fractional shares valued up to $3000 when you open and fund an account. | |

| | | | No promotion available at this time. | |

| | | | No promotion available at this time.

| |

| | | | Receive up to $700, when you establish and deposit qualifying new funds into a J.P. Morgan Self-Directed Investing account. | |

| | | | After funding an account with $2000, each referral will earn you $200. | |

| | | | No promotion available at this time. | |

🥑 Avocados & Options: A Simple Example

Let’s say you love avocados, but the price changes a lot. Today they’re $1 each, but you think prices will go up next week.

So, you make a deal with a farmer:

“Here’s $0.10. In one week, I want the right (but not the obligation) to buy an avocado for $1, no matter what the price is then.”

This deal is an option contract.

Now, let’s see what happens:

Scenario 1: Avocado prices go up to $2

You use your call option to buy for $1, even though market price is $2.

You saved $1 per avocado, minus the $0.10 you paid = $0.90 profit!

You win.

Scenario 2: Avocado prices drop to $0.80

You won’t use your option—why buy for $1 when the market is cheaper?

You let the option expire and lose only the $0.10 you paid.

You lose just the small premium.

Breakdown:

- The $0.10 is the premium (what you pay for the option).

- The $1 price is the strike price.

- The 1 week is the expiration date.

- You’re buying a call option (betting the price goes UP).

Why this makes sense:

- You’re limiting risk (max loss = $0.10)

- You have unlimited upside if prices shoot up

- It’s like a “maybe” commitment—you only follow through if it benefits you.

Why Use Options?

- Speculation: Huge gains when stock moves (with less money up front).

- Hedging: Like insurance—e.g. buying a put to protect your shares nerdwallet.com+1nerdwallet.com+1.

- Income: Sell options (covered calls or cash‑secured puts) to collect premiums regularly ally.com+1reddit.com+1.

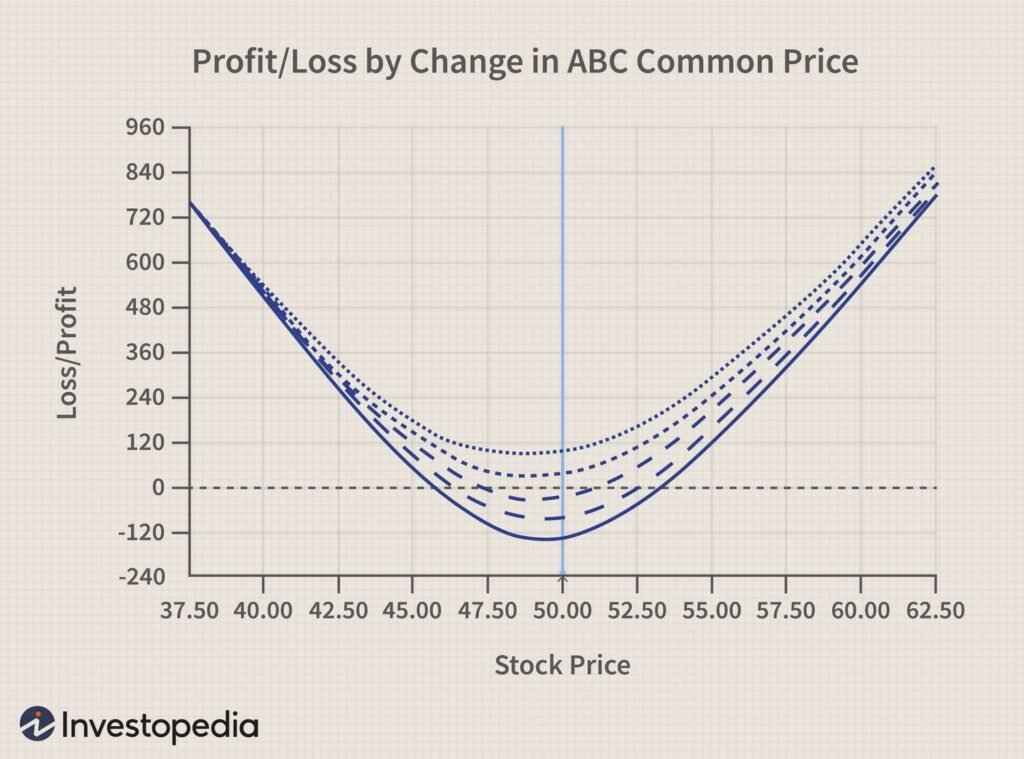

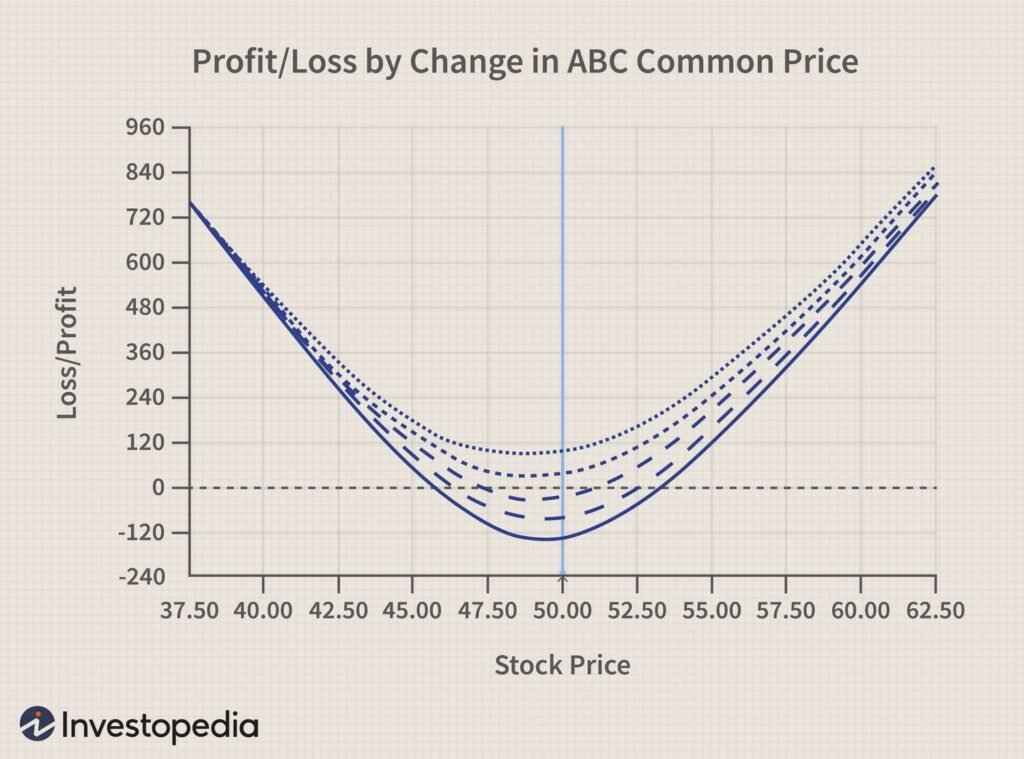

Graph Opportunity #3:

- Diagram payoff for a protective put and a covered call strategy.

5. How to Start Trading Options (Step-by-Step)

- Paper‑trade first (fake money accounts) pinterest.com+15nerdwallet.com+15nerdwallet.com+15.

- Choose a broker that supports options, has a friendly interface, paper trading, and decent commissions—this is where affiliate CTAs fit perfectly.

- Suggested CTA: “Click here to open a paper‑trading account with [Broker X] and get $XXX welcome bonus!”

- Get approved: brokers have tiers based on your experience and portfolio size investopedia.com.

- Pick strike & expiration wisely—don’t go wild.

- Place the order: Buy to open call/put; Sell to open (if you’re the seller) investopedia.com.

- Exit or exercise: You can sell to close, exercise, or let it expire worthless.

- Manage risk & review: Learn from each trade, track commissions and losses.

6. Common Beginner Mistakes

- Diving in before understanding Greeks or time decay (theta)

- Selling naked options without knowing exposure

- Picking weird expirations with no clear strategy

- Ignoring commissions or liquidity

7. Tips to Trade Smart

- Start with easy trades: buying calls or protective puts.

- Don’t sell naked options unless you have big margins.

- Use spreads once you get basics investopedia.com+5nerdwallet.com+5nerdwallet.com+5reddit.com.

- Treat paper trading like real money—emotion still matters.

- Be patient: options are a marathon, not a sprint .